Beef Deforestation Scorecard

Evaluating global food brands' progress on providing consumers with deforestation- and conversion-free beef products

Executive Summary

Top global food brands – including restaurant chains such as McDonalds and supermarkets Tesco and Carrefour – have failed to eliminate deforestation from their global beef supply chain, despite pledging to do so by 2020. To date, companies have mobilized through industry groups like the Consumer Goods Forum to address problems in the supply chains of other high-risk commodities like soy, palm oil, and timber. However, notably less attention has been given to tackling the destruction created by the beef sector.

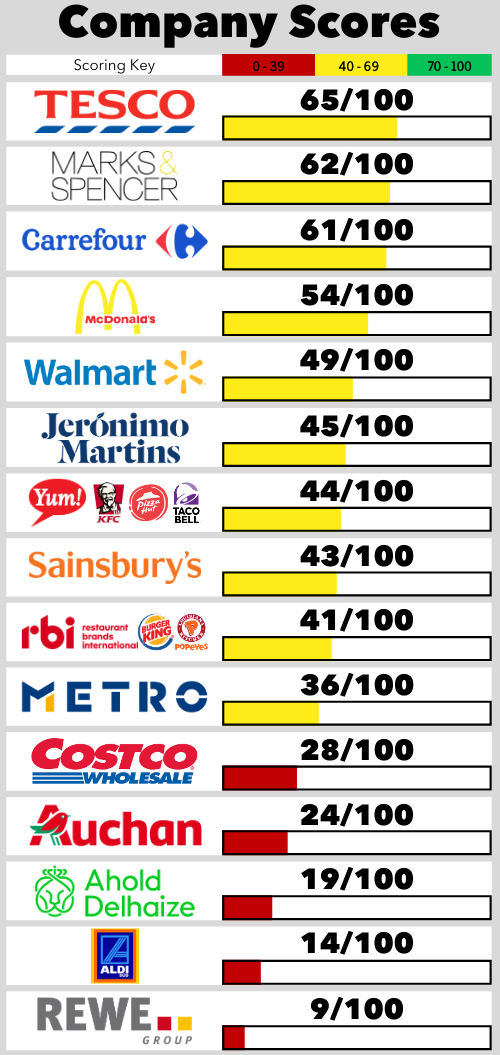

A new scorecard, released by Mighty Earth, finds a large gap remains between what global food brands promised to do about deforestation and actual action undertaken on their beef supply chains. Despite the outsized destruction generated by the cattle sector, only four companies – Tesco (65/100), Marks & Spencer (62/100), Carrefour (61/100), and McDonald’s (54/100) – have begun to implement their deforestation and conversion-free (DCF) commitments for beef products. These four companies hold the top scores but still only earned roughly half of the total possible points in the scorecard. While multiple companies had policies promising to mitigate deforestation in their beef supply chains, these policies often applied to only a portion of their products, lacked clear monitoring and enforcement protocols for evaluating supplier compliance, and had little public reporting on progress.

Mighty Earth’s Beef Deforestation Scorecard comprehensively evaluates the extent to which companies have delivered on their promise of providing consumers with deforestation and conversion-free (DCF) beef.

By assessing performance across three distinct criteria – policy commitment, monitoring & verification, and public reporting – this new scorecard highlights how consumer-facing companies are failing to adopt and implement robust commitments to sustainable beef sourcing. The accompanying report identifies the policy requirements and supplier management protocol urgently needed to mitigate the destruction of native ecosystems embedded in their global beef supply chain.

Cattle is the most significant driver of agriculture-linked native ecosystem conversion, with pasture responsible for 63% of global tree cover loss tied to industrial agriculture between 2001 and 2015.[i] While much of the media’s attention is on the Brazilian Amazon, cattle-driven land clearance also threatens other critical biomes like the Cerrado and Pantanal in Brazil, the Gran Chaco region of Paraguay and Argentina, and a variety of native ecosystems across Australia. In Brazil, just three companies – JBS, Marfrig, and Minerva – have majority control of the beef sector, and each have enabled continued destruction associated with the industry.[ii] However, these big meatpackers have consistently evaded accountability for their supply chain impacts, indicating a lack of pressure from their key customers – global supermarket and fast-food chains.

Rewe (9/100), Aldi Süd (14/100), Ahold Delhaize (19/100), and Auchan Retail (24/100) were the worst performing companies according to the scorecard. Our assessment shows that these companies did not have beef specific DCF commitments, and thus had not established adequate policy, monitoring systems, or reporting practices on their global beef supply chains. Any points awarded to these companies was for relative overlap achieved by their global human rights protocol.

Tesco (65/100) scored the highest, followed by Marks & Spencer (62/100) in second place. Our assessment shows that both companies had strong commitments for forest protection, implemented the policy for DCF beef by cutting contracts with problematic suppliers and demonstrated supplier traceability to the farm level. The two companies were the only ones to demonstrate effective use of the ‘suspend and engage’ approach with their beef suppliers, having cut contracts with non-compliant suppliers and prioritized sourcing from low-risk suppliers.

Carrefour (61/100) and McDonald’s (54/100) came in third and fourth place. Our assessment shows that the content of environmental and human rights protections outlined by both companies’ policies was relatively strong (covered conversion across high-risk sourcing regions), but weak on implementation by failing to monitor and enforce compliance across the full scope of their beef supply chain. Both companies failed to demonstrate effective monitoring of indirect beef suppliers, which are responsible for most of the deforestation and native ecosystem conversion for cattle production.

To reduce the risk of sourcing beef products tainted by clearance of native ecosystems and human rights violations, and achieve DCF beef supply chains, food retailers should:

- Adopt time-bound, specific commitments to eliminate deforestation, native ecosystem conversion, and human rights abuses from their global beef supply chains.

- Ensure effective implementation by monitoring suppliers’ practices and requiring suppliers to provide evidence of compliance.

- Suspend or drop all contracts with top offenders, such as JBS, to demonstrate seriousness of penalties resulting from continued compliance violations.

- Regularly and publicly report on progress toward DCF beef commitments, using verified metrics and disclosing suppliers to enhance supply chain traceability.

Introduction

Cattle is the top driver of environmental degradation caused by global agricultural production, perpetuating greenhouse gas emissions, clearance of native ecosystems, water pollution, and species extinction. While the soy and cattle sectors are the largest drivers of deforestation and native ecosystem conversion.[iii] Despite conservation efforts across South America, destruction of critical ecosystems – such as the Amazon Rainforest, Cerrado, Pantanal, and Gran Chaco biomes – continues due to the unregulated and uncontrolled cattle sector.[iv]

The cattle industry is notorious for its blatant disregard for the environment, public health, and rule of law, with three of Brazil’s largest meatpackers – JBS, Minerva, and Marfrig – consistently found linked to these problems. Mighty Earth’s Soy & Cattle Deforestation Tracker[v] found over 150,000 hectares of deforestation and native ecosystem conversion over the past two years connected to the supply chains of all three meatpackers, earning them some of the lowest scores in the tracker’s assessment. JBS is connected to the most clearance by far – a whopping 100,000 hectares, an area larger than Berlin – about 75 percent of which occurred in protected areas and, thus, is presumably illegal. Meanwhile, Marfrig and Minerva are connected to more than 50,000 hectares of clearance each, the majority of which is potentially illegal. [vi]

Global food brands are the gatekeepers between meat suppliers and consumers and are uniquely positioned to drive reforms in the supply chain. Brazil’s biggest meatpackers are reliant on export markets for around half of their annual revenue,[vii] meaning companies in foreign markets have considerable leverage over Brazil’s beef sector by continuing to purchase from just three companies. Many consumer goods companies have sought to use their role in the supply chain to demand meatpackers improve their sustainability practices, and the practices on the farms that supply them.

Indeed, in response to pressure from foreign markets concerned about deforestation in recent years, all three meatpackers have made a variety of commitments to stop further clearance in Brazil. Unfortunately, these commitments are limited in scope and enforcement, allowing clearance to continue rising across the continent and around the world. To date, the three largest meatpackers – JBS, Marfrig, and Minerva – participate in sustainability agreements that only address the Amazon, and even then, only as of 2020 do they include commitments to monitor indirect suppliers from which the vast majority of cattle originate. As such, immediate action is needed to expand the commitments beyond the Amazon, and to implement the commitments for all suppliers.

Awareness about the environmental impacts of meat production is translating into new market expectations that companies need to be aware of and responsive to. A 2018 survey estimated 70% of the world’s population reported reducing their meat consumption that year,[viii] a trend that is likely to continue as health and environmental concerns influence purchasing preferences of younger generations (Gen Z and Millennials).[ix] Awareness about the environmental impacts of meat production is translating into increased pressure on policymakers to better regulate the sector as part of climate and human rights regulations. Both the U.S. and the European Union have been increasing their imports of Brazilian beef while simultaneously experiencing an awakening of the population increasingly concerned about climate change and the sustainability impacts of their food. Indeed, numerous surveys from the U.S. and E.U show that consumers are increasingly prioritizing sustainability as a top concern, rising from a preference to an expectation that informs which brands they choose to purchase.[x] Meat retailers– supermarkets, fast-food chains, and food service companies – must adapt today to meet the expectations of tomorrow’s market by better aligning their global supply chains with public expectations for sustainable business practices.

Food companies now more than ever are expected to take direct responsibility for evaluating and mitigating the harmful impacts of their supply chains. Company shareholders recognize this and are increasingly calling on corporate boards to demonstrate strong sustainability strategies. For example, global investors representing $30 trillion AUM have joined the Farm Animal Investment Risk and Return (FAIRR) network, which is focused on understanding and managing the sustainability risks in the global meat industry. Clearly, the public is increasingly seeking ways to reduce the environmental impacts of their meat consumption and expect their favorite brands to provide more sustainable options.

Given the mounting evidence of persistent problems tied to beef production, it is critical for consumers and the public to understand how companies are performing against their own deforestation and conversion-free (DCF) commitments for beef. While numerous analyses of corporate policies on forests exist, these limit their analysis to the policy and point to a gap in company beef sourcing efforts without going into more detail. To fill this gap in public understanding, Mighty Earth has created a scorecard assessing major supermarket and fast-food chains on their efforts to address beef-driven deforestation and native ecosystem conversion by evaluating not just the content of DCF beef commitments, but also implementation measures, and on-going transparency of the supply chain. Our analysis identifies opportunities for industry leadership and highlights key strengths and weaknesses across retailers’ efforts to address sustainability risks in the cattle sector.

Methodology

Company Selection

This scorecard evaluates the policies and practices of the largest, and most influential global fast-food and grocery chains. The companies profiled in this scorecard were selected based on their existing commitments on forest clearance, either as part of individual company policies or private sector initiatives such as the Consumer Goods Forum (CGF) or Tropical Forest Alliance (TFA), as well as prominence in global markets, particularly the United States, European Union, and Latin America. Together, the companies scored in this report represent over $1.2 trillion in global sales every year and are in a unique position to influence meatpackers to mitigate key sustainability concerns.

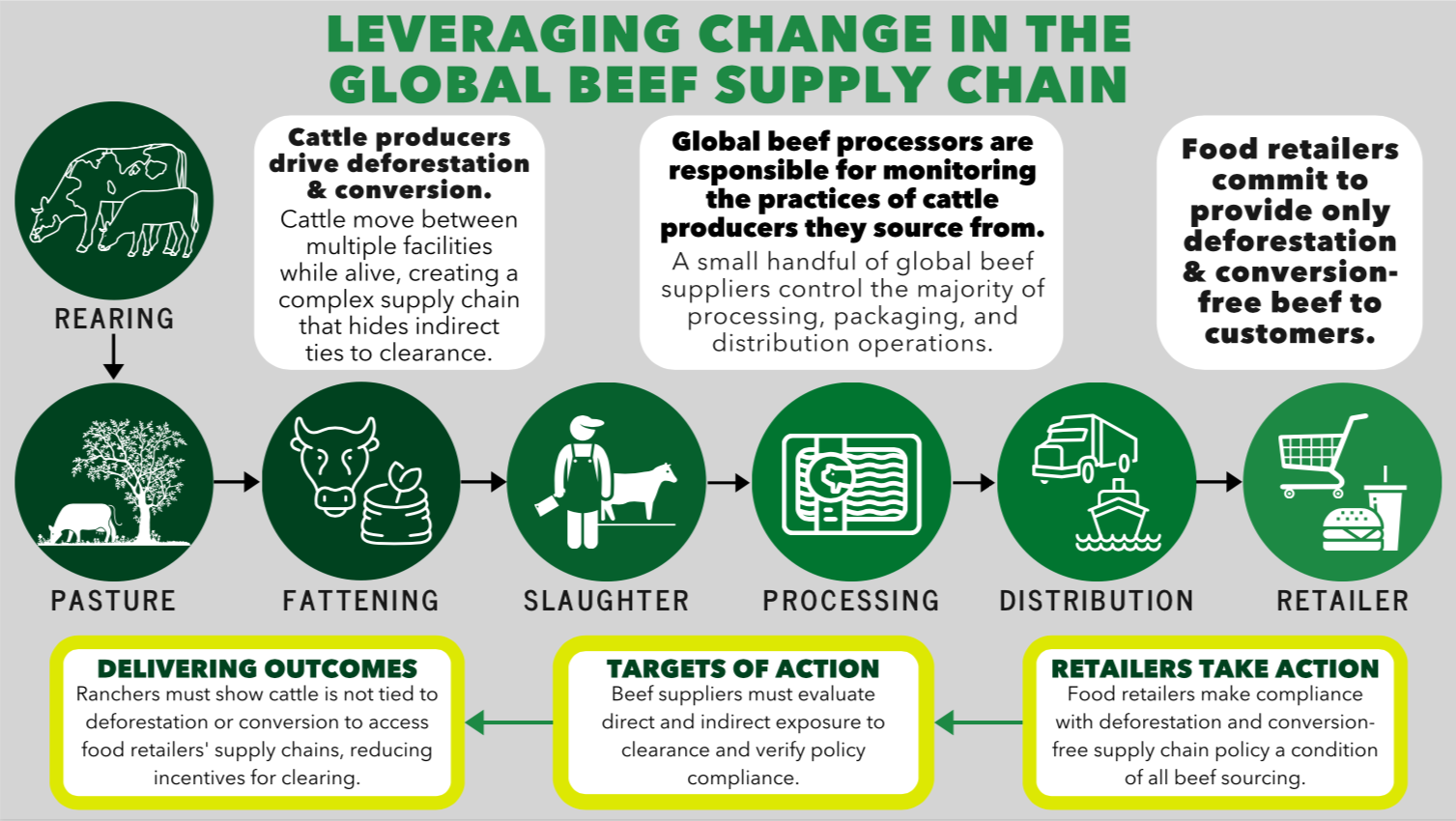

A note on terminology: The beef supply chain consists of a wide variety of stakeholders that are responsible for getting beef from farm to plate. This includes actors responsible for rearing, feeding, and slaughtering cattle, to beef processing and packaging facilities, managing distribution and trade networks, and to the retailers and fast-food companies selling directly to consumers. This scorecard is specifically assessing the actions of the food companies that sell beef to the public, and thus uses the term ‘companies’ about those selling beef to consumers. All other entities are referred to as ‘suppliers,’ with ‘direct suppliers’ pointing to the global traders that process and sell beef to retailers and ‘indirect suppliers’ pointing to the rearing farms, cattle ranchers, feedlots, and slaughterhouses involved in production further up the supply chain.

Scoring Criteria

This scorecard evaluates the policies and actions taken by food retailers to mitigate deforestation and native ecosystem conversion across their beef supply chains. While food retailers do not produce beef, they are the gatekeepers between producers and consumers, and thus have influence and responsibility over supplier practices. As a key purchaser of beef products, retailers can establish and implement requirements that set a clear standard of behavior for the rest of the supply chain – especially when it comes to land conversion and human rights. These companies purchase a variety of products – including fresh, frozen, and processed beef products. Leather products are excluded from analysis of companies in this scorecard, which figures prominently as an end-use for cattle production but is not a food product and is processed and sold through different channels.

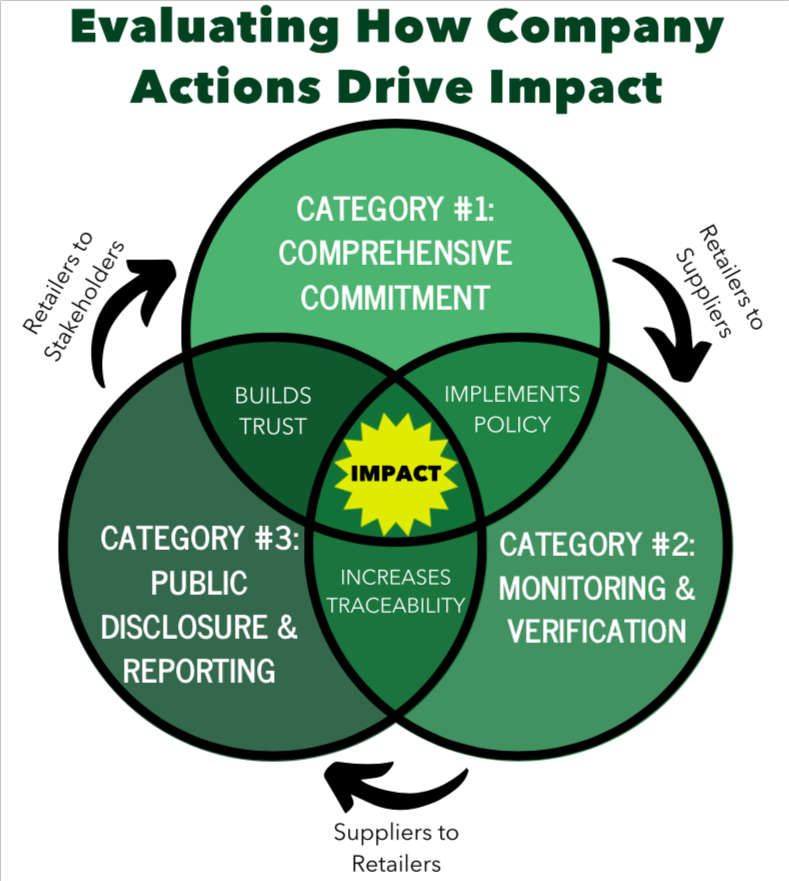

Companies were scored on their policy commitments, monitoring and verification systems, and public reporting on progress. It is important to note how the categories work together to drive change: company commitments are a critical first step for outlining a company’s vision, but policies must be specific and time-bound to drive action. Clear monitoring systems for compliance and robust supplier requirements are necessary to ensure DCF beef commitments are implemented with suppliers. These systems are critical tools that aid companies in regular and transparent reporting, which enables industry-wide reforms through knowledge sharing and enhances public trust in companies keeping their promises. The criteria were chosen in alignment with the Accountability Framework Initiative’s Core Principles.

- Policy Commitment: (38 points total) This category evaluates the retailer’s policy commitment and measures performance by how well the commitment integrates three essential elements: content (who and what is protected by the goal); scope (the extent of the retailer’s operations the policy is applied to, and the stringency of the performance standards being set); and advancement of industry transformation (alignment with broader goals, policies, and initiatives to shift production practices and consumption patterns).

- Monitoring & Verification: (44 points total) This category evaluates the systems retailers have in place to implement their DCF beef commitments across suppliers. Performance in this category is evaluated in two categories: company internal procedure (the policies and protocol retailers have established in-house to effectively monitor performance, determine compliance, and engage with beef suppliers), and supplier requirements (the requirements that retailers have for suppliers to conduct effective monitoring, verification, and reporting to ensure compliance across all cattle sourcing).

- Public Disclosure & Reporting: (18 points total) This category evaluates the retailer’s reporting and disclosure practices and assesses performance based on the company’s reporting of progress toward DCF beef commitments and overall contribution to traceability of the cattle sector by disclosing supply chain information.

Each company’s performance was scored across three corresponding categories for 100 total points, with the number of points weighted to show the relative value of different actions. See Appendix I for an expanded list of indicators in each category and an overview of how points were awarded for each indicator. Criteria were selected and designed to align with the Accountability Framework operational guidance.

Data Sources

Company scores are based on assessments of public information and direct engagement between Mighty Earth and individual companies. For each company, an in-depth review of publicly available information was used to evaluate performance through statements available on company websites, annual reports, and disclosure to the Carbon Disclosure Project. Additionally, Mighty Earth staff conducted multiple rounds of engagement with each company to provide notification of the report and provide companies with an opportunity to share additional public information relevant to their score.

Analysis of Company Scores

Broadly speaking, the Beef Deforestation Scorecard demonstrates an industry-wide failure to tackle the issue of beef-driven deforestation and native ecosystem conversion. The companies that were awarded the most points – Tesco, Marks & Spencer, Carrefour, McDonald’s, and Walmart – still only met about half of the criteria to comprehensively leverage change further up the supply chain. Companies performed better for the quality of their DCF beef commitments than on their implementation or progress reporting. The following sections explain the expectations companies should strive to meet for each category, provide details on individual companies’ performance in each category, and list key recommendations for companies to prioritize.

An analysis of company performance illuminates four areas of improvement for global supermarket and fast-food chains to prioritize to eliminate deforestation and native ecosystem conversion from their global beef supply chain:

- First, companies must update the language used in their commitments to include deforestation and native ecosystem conversion, integrate human rights protections, and cover sourcing of all beef products, sourcing regions, and direct and indirect suppliers.

- Second, companies need to drastically improve their monitoring systems and supply chain management protocol to address the impacts and drivers of consistent compliance violations.

- Third, companies must couple compliance monitoring systems with robust reporting requirements to ensure performance is demonstrated in such a way that measures progress and advances traceability of the beef sector more broadly.

- Lastly, companies need to improve transparency by annually reporting on progress toward commitments, expanding insight into the traceability of their beef supply chain, and publicly disclosing all beef suppliers.

Policy Commitment

Policy commitments are the first step companies need to take to achieve the desired outcome of eliminating deforestation and native ecosystem conversion from their supply chains. A company’s policy lays out the standards that stakeholders can expect to be implemented, and against which evaluations can be made about progress and overall success. This first category scores companies on how well their policy commitments align with three crucial elements to effectively address problems in their global beef supply chains: content, scope, and timeframe.

What were we looking for?

Content: Company policies were first assessed according to the standards laid out for environmental and human rights protections. While deforestation in Brazil’s Amazon is the most high-profile example of native ecosystem conversion caused by cattle production, other biomes are also at risk. Points were awarded for the extent to which companies specified a commitment for banning all native ecosystem conversion and setting a goal for a deforestation and conversion-free (DCF) beef supply chain. Companies were also assessed on the extent to which human rights protections were included in company policies to protect against issues facing local communities and workers such as slave labor, land grabbing, and violence against Indigenous Peoples driven by the cattle sector.

Scope: Company policies were also assessed on the scope of the company’s supply chain to which it is applied. A comprehensive policy is one that applies to all beef products in a company’s supply chain, all markets in which the company operates, and all suppliers (direct and indirect) involved in production globally. Unless commitments are holistically applied across the beef supply chain – including private-label and external brands in all geographies – retailers are still enabling and incentivizing further environmental damage by maintaining a secondary market to which their sustainability policies do not apply. Another element evaluated in this area was whether company policies have a clear date for implementation. Points were awarded in this area for companies that set target dates, which make it easier to measure progress toward full implementation over time. Setting a cut-off date for conversion was another means of making policy commitments quantifiable. When a company stipulates a cut-off date for sourcing for conversion in their policy commitment, all future beef suppliers are required to verify that their production has not been associated with conversion since before the cut-off date.

Joint Action: Finally, companies were assessed on the extent to which they align individual actions to advance industry transformation more broadly. Companies earned points for enacting policies that help reduce consumer demand for beef products, including goals to increase sales for plant-based protein alternatives. Companies were also evaluated on the extent to which they advocated for national policy initiatives that would protect native ecosystems and human rights (both in high deforestation-risk countries and the relevant places they operate in the US or EU). Lastly, companies were awarded points if they were members of industry initiatives actively working to combat and prevent native ecosystem conversion and human rights abuses caused by the beef sector, including the CGF’s Forest Positive Coalition, the Tropical Forest Alliance, the GRSB-GTPS Joint Working Group on Forests, and the Accountability Framework Initiative.

Company Performance

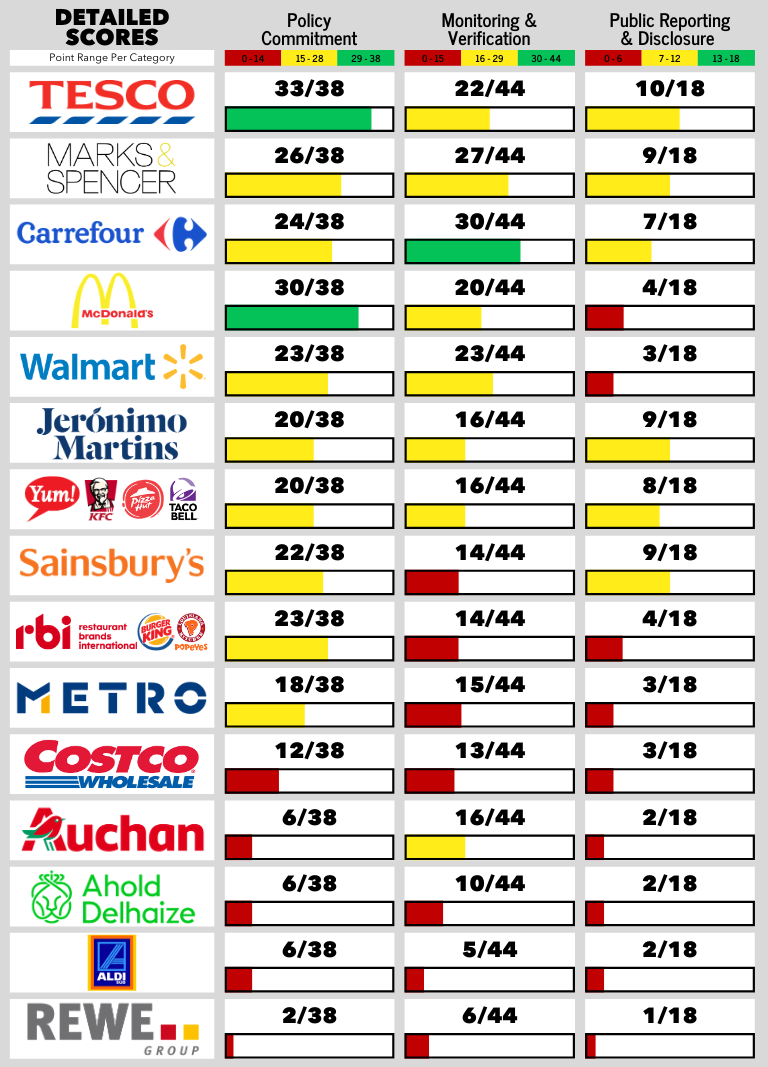

Relative to other categories, companies performed higher on average across all indicators related to their commitments for deforestation and conversion-free (DCF) beef. Both Tesco (33/38) and Marks & Spencer (26/38) stood out as top performers in this category because their commitments were strong in terms of both content and scope and they both demonstrated clear leadership on supply-chain transformation and participation in key industry groups. For example, Tesco’s policy commitment covers forest and human rights protections and has already been implemented (since all beef products are sourced from the UK and Ireland), but in 2020 Tesco announced a commitment to increase sales of plant-based protein alternatives in addition to the on-going pressure it puts on Brazilian meatpacker JBS. Marks & Spencer’s approach to ensuring beef-driven clearance is unique in that its direct suppliers can only source beef from a pre-approved list of ranchers and meatpackers, which the company actively monitors (see more below). Marks & Spencer is a member of the Tropical Forest Alliance and, in addition to dropping all beef sourced from high-risk regions, has been a strong advocate for forest protections at the national and multilateral levels.

Additionally, Carrefour (24/38), McDonald’s (30/38), and Walmart (23/38) scored highly in this category. These companies performed satisfactorily in all criteria related to the content included in their commitments, extending protections for all native ecosystems and human rights. Carrefour and McDonald’s also clearly demonstrated themselves as advocates for national policies forest protection and active participants with initiatives for industry transformation. However, the commitments made by all three of these companies failed to cover an adequate scope of their business operations to provide a comprehensive solution to the problems they commit to address. For example, Carrefour’s policy only applies to direct sourcing of fresh beef - own-brand and private label - in its locations across Brazil, while Walmart’s policy is limited to fresh beef products under the company’s private label.

The worst performing companies – Metro AG (18/38), Auchan (6/38), Ahold (7/38), Aldi Süd (6/38), and Rewe (2/38) – earned low scores in this category because they failed to have any commitment to eliminate deforestation or native ecosystem conversion in their beef supply chains. Instead, they each pointed to their efforts to address the destructive impacts of soy production as a priority over action on beef. The importance of eliminating deforestation and native ecosystem conversion embedded within global soy supply chains cannot and should not be understated, particularly for European companies’ sourcing of animal feed. However, companies should not conceive of beef and soy as interchangeable commodities with high deforestation-risk. While Auchan and Aldi Süd both referred to policy targeting beef-driven deforestation, which exists in some of the markets in which they operate (e.g. locations in Germany or France), these efforts pale in comparison to the global initiatives these companies have undertaken on soy. Without establishing a policy across global operations limiting the company’s sourcing of beef to low deforestation-risk countries – like Tesco and Marks & Spencer – these companies are not doing enough to eliminate deforestation or native ecosystem conversion from their beef supply chain.

Recommendations:

- Protect all native ecosystems from conversion: Companies should aim for deforestation and conversion-free beef supply chains, extending policy protections beyond forest areas to include all native ecosystems against threats from expanding industrial agriculture.

- Expand sustainability requirements across the whole beef supply chain: Ensure policy commitments extend globally and apply to direct and indirect suppliers across all sourcing regions, operating markets, and private and own-brand product lines.

- Provide clear timelines for achieving full policy implementation: Commitments should include a target date for full implementation by 2025 or sooner and stipulate a clear cut-off date that aligns with industry standards (see Scoring Criteria 1.2E for details).

- Advance industry transformation: Companies should supplement individual action with collaborative efforts that support transformation of the production and retail industries’ capacity to prevent clearance in beef production. These efforts include supporting shifts in consumer preferences (e.g. for plant-based protein options), advocacy that upholds forest protections and land rights in national legislation, and membership in leading industry groups (see Scoring Criteria 1.3C for details).

- Integrate human rights protections: Commitments should ban human rights abuses associated with the cattle sector, such as slave labor, land grabbing, and violence against Indigenous Peoples.

Monitoring & Verification

Regardless of how robust a company’s commitment to protect forests might be, corporate sustainability policies will only drive change if implemented. Successful implementation of a company’s DCF beef commitment is dependent on the monitoring and verification systems food retailers have in place for evaluating supplier compliance. These can be broken into two categories: the internal procedures companies have for monitoring and evaluating their supply chains, as well as the requirements companies make of their suppliers to ensure they demonstrate and verify compliance. Companies should embed their sustainability policies into operational systems that effectively monitor and verify supplier compliance. By requiring suppliers to demonstrate compliance with company policy, food retailers can enhance traceability and accountability across the beef sector. This category evaluates companies on both their own internal procedures, as well as on their requirements for supplier.

What were we looking for?

Company Internal Procedure: Each company’s ability to evaluate supplier compliance accurately requires a variety of monitoring activities, such as frequent risk assessments, credible mechanisms for verifying supplier practices, and clear protocols for engaging with non-compliant suppliers. Laying out this protocol establishes expectations for each company to drive change further up the supply chain, by helping suppliers meet new sourcing standards or clarifying how and when contractual penalties should be enacted in response to on-going compliance violation.

Many companies that have taken action and changed beef sourcing in response to persistent exposure to deforestation risk, but those risk analyses have mainly been limited to Brazil. Brazil represents a high concentration of overlapping supply chain risks that companies should prioritize when assessing compliance – a significant volume of beef production and an elevated level of deforestation risk. However, an overly narrow set of supply chain interventions could inadvertently spread the risk of destruction to new areas. Companies should use global risk assessments to inform and establish protocol that aligns with existing global monitoring systems and continually evaluates beef sourcing regions for deforestation risk so that suppliers must comply with strict requirements instead of exploiting loopholes.

Supplier Requirements: Suppliers are responsible for verifying that their products are not associated with deforestation, native ecosystem conversion, or human rights violations. To provide this assurance to downstream customers, suppliers need to have their own credible monitoring and verification systems, demonstrate that their direct and indirect cattle sourcing practices align with company expectations, and regularly demonstrate compliance through verified reporting. Reporting requirements also drive innovation by addressing management challenges presented by poor traceability in the cattle supply chain. Companies can push for solutions in this area by setting strict reporting requirements for their suppliers to make available the location and ownership information for all meatpacking facilities, slaughterhouses, fattening and rearing farms for their product volumes. Additionally, suppliers should be required to report aggregate assessments of their entire supply chain, including the share of sourcing for which they have traceability to the farm level and the share of sourcing that is associated with clearance or human rights violations. This provides companies with a broader understanding of their suppliers’ sourcing patterns, which lends helpful context for gauging the extent of supplier compliance.

Company Performance

Overall, this category represents the most significant area for improvement companies should focus on to mitigate deforestation and native ecosystem conversion in their supply chains. Companies that received points for comprehensive DCF commitments on beef largely failed to provide a plan for how their policies were being monitored and verified to ensure implementation. It is critical that DCF beef policies be backed with strong plans for implementation to achieve the desired change.

Carrefour (30/44) was the only company to supplement its policy commitment with strong monitoring mechanisms and supplier requirements. Despite the limited geographic scope of its policy commitment (described above), Carrefour’s score in this category shows the company is taking the issue of compliance seriously – implementing the most comprehensive protocol for beef sourcing and setting out clear requirements for suppliers to measure and report on compliance.

This could not be said of either McDonald’s (20/44) or Walmart (23/44), both of which have strong policy commitments yet do not provide details on how this policy is being implemented for their beef supply chain. Both McDonald’s and Walmart outlined several expectations for supplier compliance, but many of these are voluntary and it is unclear whether internal procedures would result in contractual penalties for non-compliance. Additionally, the two companies were the only ones with established commitments that did not make their beef sourcing protocol or supplier requirements available to the public, making it impossible to evaluate the credibility of their supply chain monitoring systems. This is an urgent area for improvement, especially since both companies have an opportunity to use their global influence to lead on transformation of the supply chain.

Tesco (22/44) and Marks & Spencer (27/44) took a different approach to earn their scores in this category, supplementing strong DCF beef sourcing protocol with thorough risk assessments and comprehensive supplier requirements to ensure 100% of beef products are sourced from low deforestation-risk regions. Marks & Spencer established a beef sourcing policy that limits all suppliers to a list of pre-approved beef producers further up the supply chain. This shows clear leadership in supply chain traceability outside of high deforestation-risk regions, as their systems for monitoring compliance are informed by the most robust set of data. In fact, Marks & Spencer’s was the only company with aggregate knowledge of its beef supply chain – no other company scored points for the criteria requiring suppliers to disclose relevant farm-level information for its direct and indirect supply chain.

Jerónimo Martins (16/44), Yum! (16/44), Sainsbury’s (14/44), RBI (14/44), and Costco (13/44) demonstrated some of the first steps for monitoring and verification – including risk analyses, engagement protocol, verification schemes, and grievance mechanisms – but largely avoided stating clear requirements for their suppliers to ensure compliance across direct and indirect beef sourcing.

Companies that had not established a commitment to achieve a conversion-free global beef supply chain were among the lowest scoring in this category, as might be expected. These companies – Metro AG (15/44), Auchan (16/44), Ahold (10/44), Aldi Süd (5/44), and Rewe (6/44) – only received points for indicators that overlapped with existing systems to protect human rights, like global risk assessments and verification procedures. These scores reflect a limited overlap on human rights compliance evaluation and general procedure on verification of supply chain monitoring but fell short of extending enforcement procedures or supplier requirements on the issue of clearance in the beef supply chain.

Overall, company scores in this category demonstrate how unprepared companies are when it comes to monitoring supplier performance and engaging with them to implement compliance. Few companies include conversion-free sourcing as a condition of supplier contracts or protocols for engaging non-compliant beef suppliers. Furthermore, companies often limit their conversion-free sourcing protocols to Brazil, and only for the small amount of beef sourced for their own private label brands. While companies have some requirements for all suppliers to comply with sourcing protocol, companies are not adapting said protocol to reduce incentives for clearance in the beef sector. Company scores in this category demonstrate that current requirements are insufficient to improve suppliers’ ability to monitor and enforce compliance with reporting and data that increases traceability of the indirect supply chain to the farm level.

Recommendations:

- Conduct Global Risk Assessments: Companies must conduct regular assessments to comprehensively evaluate exposure to deforestation and native ecosystem conversion risk within their global beef supply chain. This will ensure that any new risks of beef-driven clearance – which may arise as the sector adapts to changing legislative and market forces – continue to be monitored and excluded from companies’ supply chains.

- Establish Internal Procedure for Evaluation and Enforcement of Compliance: Companies should use global risk assessments to identify any changes needed for compliance monitoring systems to evaluate the performance of beef suppliers. Companies must establish internal procedures for regular monitoring, evaluation, and verification of compliance, including a conditionality clause inserted in all existing supplier contracts and specific protocols for supplier engagement in response to non-compliance.

- Specify Requirements for Suppliers to Demonstrate Compliance: Companies must specify the requirements in place for suppliers to monitor for compliance and ensure supply chain traceability across the whole supply chain, not just the specific product purchased. These requirements should include regular monitoring and reporting on compliance, farm-level data for both direct and indirect sourcing, and aggregate data on traceability across direct and indirect supply chains.

Disclosure & Public Reporting

Transparent reporting on progress using credible and verifiable metrics is critical for companies to demonstrate how their policies are being implemented. Without public access to critical information on progress, consumers and other stakeholders are kept in the dark on sustainability performance, and the industry is unable to share best practices that pave the way for improving standards for sustainable sourcing. This third and final scoring category evaluates companies on how well they demonstrated credibility through principles of transparency.

What were we looking for?

Transparency helps companies build accountability and share lessons learned. Companies were evaluated on their transparency in two distinct areas: statistics on their own supply chain and the extent of progress implementing their policies. On-going and consistent reporting on the status of a company’s policy implementation ensures staff is routinely monitoring compliance and signals to the public that the company sustainability claims can be trusted. Transparent reporting also enables companies to share information and enhance accountability across the industry by disclosing a list of their beef suppliers, reporting any actions taken against suppliers in response to non-compliance, and reporting performance via detailed supply chain information. These two areas of action work in tandem to show how and where improvements have been made and contextualize any celebrations of progress with relevant information used to evaluate the corresponding impacts of said progress.

Company reporting should provide information that allows customers and other stakeholders to understand how risk of native ecosystem conversion is being assessed and mitigated. This includes the results of global risk assessments, information on traceability, metrics verifying the volumes of beef that are sourced from fully compliant suppliers, and actions taken with non-compliant suppliers.

Company Performance

Companies received the lowest scores for their reporting, with key gaps being around lack of information about suppliers and traceability. Tesco (10/18) and Marks & Spencer (9/18) earned the most points due to their strong reporting and disclosure of beef traceable to Ireland & the UK. Several of the companies that demonstrated weak performance in the previous two scoring categories earned points in this third category for releasing their disclosure to CDP. Jerónimo Martins (9/18), Yum! (8/18), and Sainsbury’s (9/18) performed better than peers because their reporting to the CDP Forests disclosure contains information about the results of deforestation risk assessments, volumes of DCF beef sourced annually, and partial supply chain traceability. Outside of companies’ disclosure to CDP, Carrefour (7/18) showed the best effort toward transparency through consistent reporting on progress made toward full implementation, opportunities for further improvement identified by risk assessments, pilot projects to expand monitoring capacity, and percent of direct suppliers that are satellite monitored.

Unfortunately, most companies failed to provide meaningful information to evaluate the impacts of their supply chains. McDonald’s (4/18), Walmart (3/18), RBI (4/18), and Costco (3/18) each noted an intention of regular reporting on progress but have yet to do so in a way that comprehensively includes reporting on suppliers’ performance or traceability. Metro AG (3/18), Auchan (2/18), Ahold (2/18), Aldi (3/18), and Rewe (1/18) were awarded points for criteria which overlapped with their reporting practices related to human rights but provided little to no information specific to beef or conversion-free sourcing.

Of the companies that were actively sourcing from high deforestation-risk regions, not even one disclosed sufficient information to evaluate how regular reporting contributed to enhanced transparency. This criteria centers around sourcing practices and supply chain traceability, meaning companies with any exposure to deforestation-risk beef in their supply chain are falling short of best practices in the following areas of their reporting: summarizing actions taken against suppliers in response to non-compliance, explaining aggregate traceability in companies’ direct and indirect beef supply chains, and disclosing a list of their beef suppliers in high deforestation-risk sourcing regions.

Recommendations:

- Regularly report progress toward commitments using quantifiable metrics: At least annually, companies should report on progress toward achieving commitments, including annual volumes of conversion-free beef and findings of global risk assessments.

- Include assessments of aggregate traceability for all high-risk sourcing: In addition to the above, annual reporting should provide insight on traceability and compliance in global supply chains. This includes country of origin for all beef products, % of product volumes sourced by country, % of global volumes suppliers traceable to slaughterhouses (for both direct and indirect suppliers), and % of high-risk volumes traceable to the farm level (for both direct and indirect suppliers).

- Disclose a full list of beef suppliers and provide regular reports on supplier engagement: Companies must publicly disclose their beef suppliers – minimally disclosing those in high-risk sourcing regions – to enhance traceability in the global beef supply chain. Additionally, companies should provide summaries of all grievances filed against suppliers, the status of any proceedings taken to address claims, and any contractual penalties enacted in response to verified non-compliance by suppliers.

Conclusion

Mighty Earth’s Beef Deforestation Scorecard shows that global food brands have broadly failed to include beef in their promises to protect forests from harmful sourcing practices, despite beef having a larger role in clearance than any other commodity. Cattle-driven clearance of native ecosystems is avoidable, but few consumer-facing companies have taken the steps needed to ensure their beef supply chains are not driving land clearance. Even the companies that have established policies to source only deforestation and conversion-free (DCF) beef are failing to ensure suppliers comply with these requirements. In fact, many of the companies scored have not made compliance a condition of their sourcing agreements or enacted penalties because of non-compliance, rendering their own commitments ineffective.

Food companies can no longer afford to ignore the destruction caused by their products throughout the supply chain. It is more urgent than ever that supermarkets and fast-food chains lead efforts to stop the destruction of native ecosystems in their industry – by creating strong policies and clear implementation plans, engaging with suppliers to monitor and ensure compliance, and pushing for comprehensive industry-wide reforms to end land clearance for cattle. Leadership is not simply awarded for the promises companies make; it is earned by which actions they take to ensure their supply chains do not perpetuate on-going destruction. With climate change worsening and demand for protein rising, the public expects food companies to drive the reforms needed to safeguard a sustainable food future.

Appendix 1

Detailed scoring methodology is available here.

References

Executive Summary

[i] Global Forest Watch. (2021). Deforestation Linked to Agriculture | Global Forest Review. World Resources Institute. https://research.wri.org/gfr/forest-extent-indicators/deforestation-agriculture.

[ii] Chain Reaction Research. (2020, December). JBS, Marfrig, and Minerva: Material Financial Risk from Deforestation in Beef Supply Chains. https://chainreactionresearch.com/wp-content/uploads/2020/12/JBS-Marfrig-and-Minerva-Material-financial-risk-from-deforestation-in-beef-supply-chains-4.pdf

Introduction

[iii] Carbon Disclosure Project. (2020, October). Zeroing-in on Deforestation: Which agricultural commodities companies are addressing deforestation issues? https://6fefcbb86e61af1b2fc4-c70d8ead6ced550b4d987d7c03fcdd1d.ssl.cf3.rackcdn.com/cms/reports/documents/000/005/430/original/CDP_Agriculture_2020_Exec_sum.pdf?1603898445

[iv] Henders, S., Persson, U. M., & Kastner, T. (2015). Trading forests: land-use change and carbon emissions embodied in production and exports of forest-risk commodities. Environmental Research Letters, 10(12), 125012. https://doi.org/10.1088/1748-9326/10/12/125012

[v] Mighty Earth. (2021, February 3). Soy and Cattle Tracker. https://www.mightyearth.org/soy-and-cattle-tracker/

[vi] zu Ermgassen, E. K. H. J., Godar, J., Lathuillière, M. J., Löfgren, P., Gardner, T., Vasconcelos, A., & Meyfroidt, P. (2020). The origin, supply chain, and deforestation risk of Brazil’s beef exports. Proceedings of the National Academy of Sciences, 117(50), 31770–31779. https://doi.org/10.1073/pnas.2003270117

[vii] The Nature Conservancy & Bain & Company, Inc. (2020). Brazil’s Path to Sustainable Cattle Farming. https://www.bain.com/contentassets/33cdd9f33261429ebcfdebdb4e3df72a/bain_brief_brazils-cattle-farming.pdf

[viii] Rowland, M. P. (2018, April 2). Millennials Are Driving The Worldwide Shift Away From Meat. Forbes. https://www.forbes.com/sites/michaelpellmanrowland/2018/03/23/millennials-move-away-from-meat/?sh=467f2c1da4a4

[ix] RaboResearch Food & Agribusines. (2020, January). Alternative Proteins: Hope or Hype [Digital Presentation]. Feed Strategy Conference 2020, Georgia, USA. https://www.wattglobalmedia.com/wp-content/uploads/2020/01/IPPE-Alt-Protein-2020-FINAL.pdf

[x] Bekmagambetova, D. (2020, January 10). Two-Thirds of North Americans Prefer Eco-Friendly Brands, Study Finds. Barron’s. https://www.barrons.com/articles/two-thirds-of-north-americans-prefer-eco-friendly-brands-study-finds-51578661728